-

ALTERNATIVE INVESTMENTS

Riello Investimenti Partners SGR is an independent asset management company which has been operating for 25 years in the Alternative Investment sector in the management of both private equity and debt funds.

Our origin and industrial background constitute an important competitive advantage, enabling us to benefit from a widespread network of relationships with entrepreneurs, managers and specialized advisors.

Since Riello Investimenti Partners’ foundation, we have focused on small to medium sized enterprises, combining industrial and financial expertise to improve portfolio companies’ operating performance.

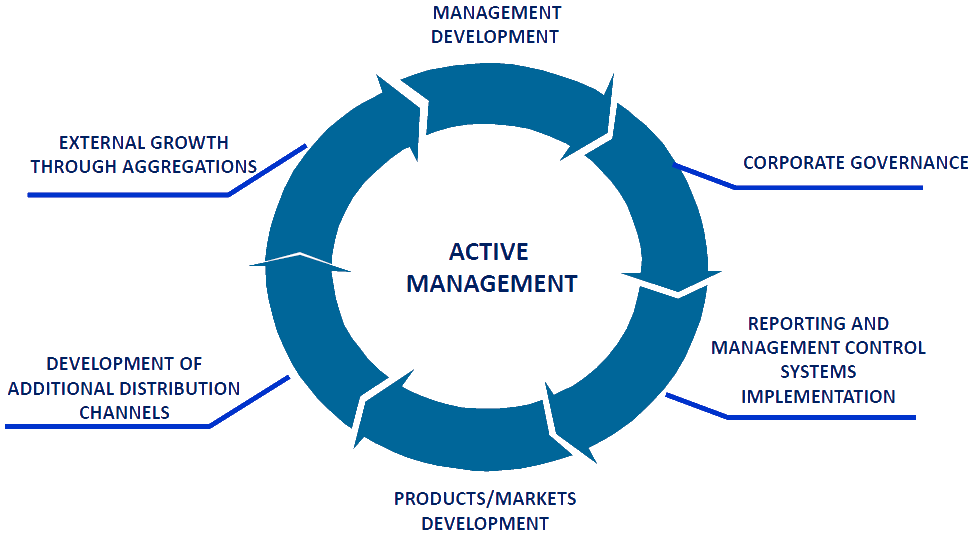

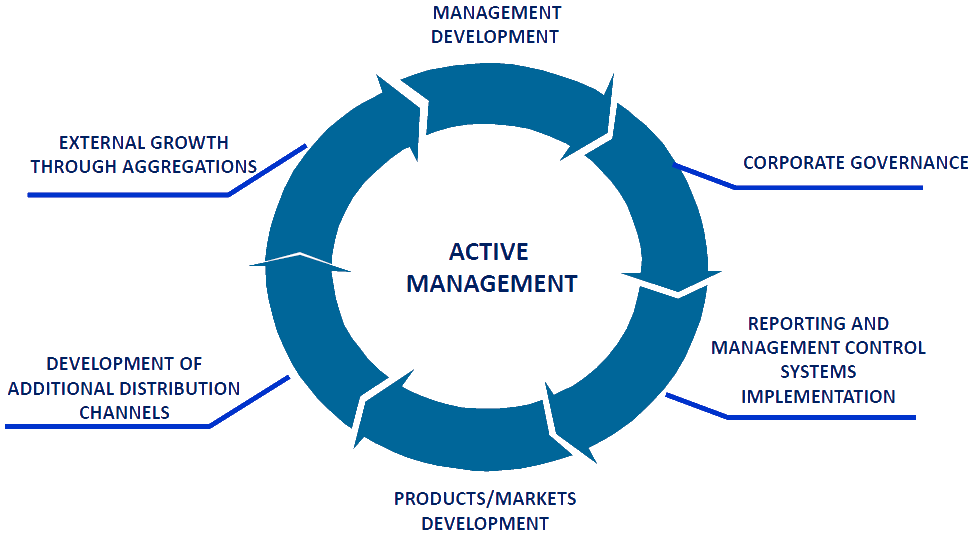

Our investment style is centred on the active management of our portfolio companies, through the development of their managerial skills, corporate governance improvement, business model reinforcement and internationalization.

Alternative investments in private equity and private debt have consistently outperformed public markets’ returns on both stocks and bonds, with a lower volatility, whilst remaining uncorrelated to key macro-trends. Our private equity and private debt strategy aims to support the real economy and the country’s economic development, assisting SMEs in the implementation of their business plan.

-

PRIVATE EQUITY

Private Equity is the main instrument to invest in the country’s real economy. It is the ideal solution for both target companies aiming to increase their growth potential, and investors, as it consistently outperformed other asset classes, while also being adequately decorrelated, diversified and benefitting from lower volatility.

Italian SMEs, backbone of our industrial system, represent the major opportunity to invest in the real economy.

The funds managed by Riello Investimenti Partners are mainly involved in majority stake or qualified minority acquisitions.

We are focused on traditional “Made in Italy” industries, those with great value generation potential, with solid fundamentals and leadership potential.

We support growth on domestic and foreign markets, as well as new aggregation projects through ("build up") strategies. -

PRIVATE DEBT

Among the first movers in the Italian Private Debt market, we have been investing in this asset class since 2016. We have been focusing on debt instruments, “minibonds”, issued by Italian SMEs to provide the most efficient capital structure to support their growth and ensure diversification of their financial sources.

Our investment approach includes arranging, underwriting and holding the debt instrument in our portfolio until its maturity (“buy & hold”); we share the requirements and outcomes with our portfolio companies, and provide guidance to identify and support future development plans.

We evaluate our target companies’ strategic plan and business model and continuously monitor their development achievements, following an “equity style” approach. -

ORIGINATION & DEAL FLOW

80% of Italian enterprises are controlled by family groups and 25% of them are facing generational transition, a critical phase of the business lifecycle that represents, by far, the most important deal flow opportunities.

Riello Investimenti Partners Sgr, owing to an efficient origination process, has analysed over 650 investment opportunities over the last 10 years, 450 of which are private equity and 200 private debt.

The strong local roots and the consolidated relationships with entrepreneurs, managers and advisors are reflected in its proprietary strategic deal flow. -

INVESTMENT PROCESS AND PERFORMANCE

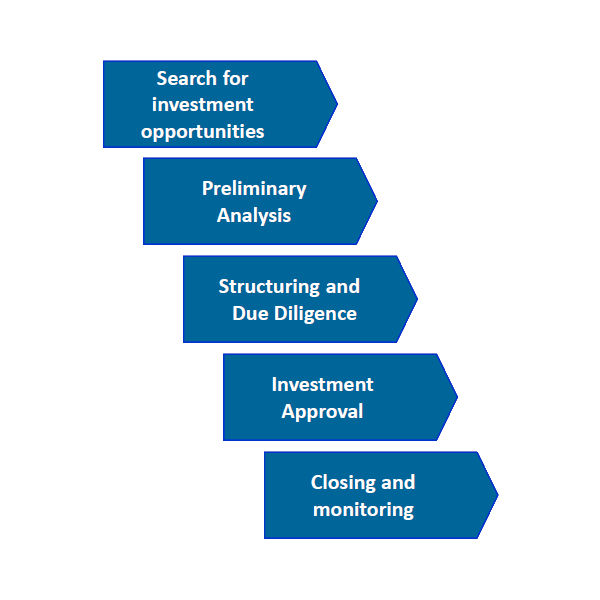

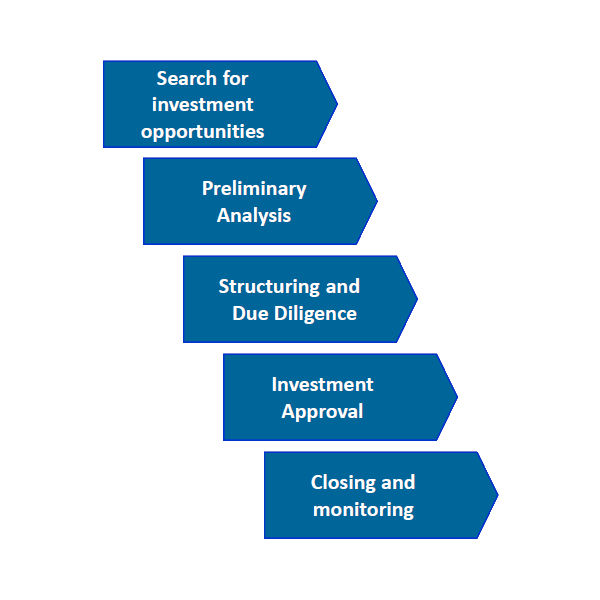

The fund’s management process executed by Riello Investimenti Sgr comprises five consecutive phases:

The process involves contribution from the Investment Team, Investment Committee, Risk Managers, Compliance, Key Managers and Advisors.

Private Equity Funds

Since our inception, we have successfully completed 16 investments and 3 add-ons with 14 divestitures, for a total 45 fully managed and executed transactions.Debt Funds

Our “equity style” approach grants investor returns that are aligned with the standards required for this asset class, with consistent cash flows and distribution of proceeds across the whole funds’ duration.

To date, we have completed 20 operations, predominantly arranged and managed as Minibonds, to support Italian SMEs in addition to traditional debt instruments, and to diversify between financial sources.