ESG AND SUSTAINABILITY

ESG AND SUSTAINABILITY

Riello Investimenti Partners SGR has always believed that a focus on ESG (Environmental, Social and Governance) topics creates substantial and long-term value, for both the individual company and the entire production system. Consideration of environmental, social and good governance factors in the investment process allows for a wider and more in-depth understanding of the sustainability risks and development opportunities of the companies subject to investment and, as a result, the ability to generate adequate returns over time. In line with these convictions, the asset management company has adopted a proprietary model of ESG analysis and assessment for subsidiaries or issuers, to supplement the traditional financial analyses of risk and return, with the aim of identifying and assessing a company’s various levels of ESG risk and monitoring its current or prospective sustainability performance.

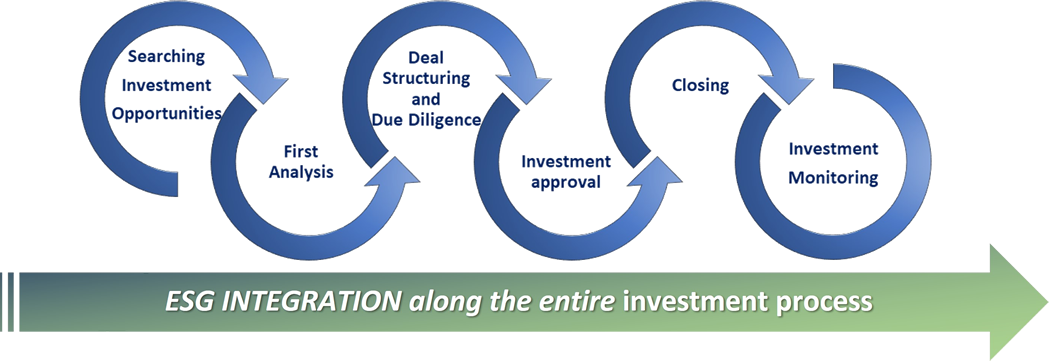

The integration of sustainability factors into investment decisions (ESG integration) involves the consideration of ESG aspects in all stages of the process, according to the requirements of the Corporate Social Responsibility Policy and by virtue of the assessment of the negative effects of investment decisions on sustainability factors, in the following areas:

(a) the exclusion of controversial sectors (such as weapons, tobacco, gambling and prostitution) or companies with unsustainable sustainability risks, (b) the identification of potential sustainability risks and identification of opportunities for improvement, (c) the active engagement of the asset management company with the company subject to investment in order to positively influence its conduct in terms of sustainability, and (d) the periodic assessment of improvements by the company in the three E, S and G pillars with the aim of pursuing a positive social and/or environmental impact.

The analysis model is inspired by the 17 Sustainable Development Goals of the United Nations and the newest and most rigorous international standards on sustainability.

The asset management company has subscribed to the 6 principles for responsible investment PRI, which it joined in 2020.Since 2021, the asset management company has been a member of the Italian Sustainable Investment Forum.

For more information about Riello Investimenti Partners SGR’s commitment to sustainability, see the Corporate Social Responsibility Policy and the ESG Disclosure.

PRINCIPAL ADVERSE IMPACT

“Riello Investimenti SGR is an independent asset management company, active in the closed-end investment funds, which invests in Italian SMEs through majority/minority shareholdings or bond underwriting. The sustainability initiatives carried out by the target companies are important in term of potential impacts, both positive and adverse, of Riello investment choices on sustainability factors. In compliance with Article 4 of the European Regulation (EU) 2019/2088 “Sustainable Finance Disclosure Regulation” (SFDR) and the Delegated Regulation (EU) 2022/1288, Riello Investimenti SGR states that it considers the Principat Advers Impact on its investments decisions (PAI).