-

PRIVATE EQUITY I & II

LIQUIDATED AND IN LIQUIDATION FUNDSGATE - PRIVATE EQUITY II

Launched in 2008, it is regulated by Banca d’Italia and subscribed by institutional investors and industry groups. The Fund, with a €65 Mio commitment, has completed 6 investments in broadly diversified sectors decoupled from the global economic crisis environment, achieving adequate performance.

FCF - PRIVATE EQUITY I

FCF, Private Equity Fund I, a captive vehicle managed by Riello Investimenti, with a €35 Mio commitment has completed 7 investments in small medium enterprises. FCF Fund was liquidated in 2007.

Main Operations

Giuseppe Bellora S.p.A.

The company, founded in 1883 in Fagnano Olona (VA), specializes in the weaving of linen, hemp and cotton and in the marketing of home fabrics under the "Bellora" brand.

Operation Detail

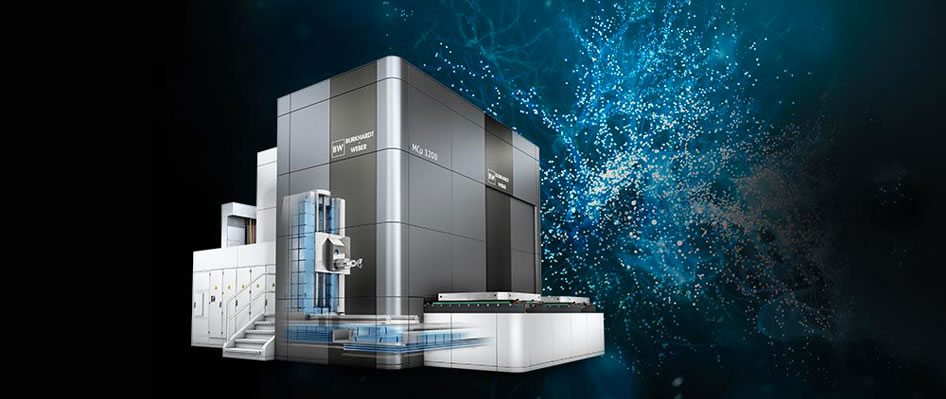

Burkhardt Weber Gmbh

Burkhardt Weber Gmbh is recognized as one of the most prestigious companies in the production of machine tools and horizontal machining centers, positioning itself in the high end of the market. Over the years it has been able to maintain its quantitative level unchanged by continuing to develop know-how in the production of high precision machining centres.

Operation Detail

Golden Goose S.r.l.

Golden Goose S.r.l operates in the luxury fashion apparel sector and specializes in the creation and marketing of high-end footwear, accessories and casual clothing characterized by high quality materials and a sophisticated design. The company holds the "Golden Goose Deluxe Brand" brand, characterized by strong visibility and recognisability.

Operation Detail

Pool Service S.r.l.

Pool Service S.r.l. was founded in 1986. produces hair care products intended for the professional channel (hairdressers). The company, with headquarters and factory in Cairate (Va), distributes its products under third-party brands on the specialist distribution channel and partly under its own brand and has a strong propensity towards international markets.

Operation Detail

-

Private Debt

impresa ITALIAPrivate Debt fund Impresa Italia was launched in 2016 as one of the first in Italy, with €70 Mio commtiment. The fund invests in structured debt instruments, the minibonds, issued by Italian SMEs. Between 2016-2020 the fund completed 17 deals.

It's investors are predominantly institutional investors.

Impresa Italia Fund is currently active, but subscription period is concluded.Main Operations

Spinosa S.p.A.

Spinosa S.p.A. produces and markets DOP buffalo mozzarella from Campania in Italy and abroad.

Operation Detail

ETT

ETT S.p.A. specializes in technological innovation and experience design, leader in ICT solutions in the cultural sector.

Operation Detail

Energon Esco S.p.A.

Energon Esco S.p.A. is an ESCO (Energy Services Company) from Modena, which builds or redevelops energy production systems (heat, cold, electricity) allowing cost savings and promoting greater energy efficiency.

Operation Detail

Gruppo CMC

CMC is a leader in the design and construction of highly innovative machinery for packaging and mailing.

Operation Detail

-

Private Equity III

ITALIAN STRATEGYPrivate Equity Fund III, Italian Strategy has 117 Mio Asset under Management, raised from high net worth individuals and leading institutional investors: Pension funds, Foundations, including investors that have previously underwritten funds managed by Riello Partners Sgr.

Italian Strategy is focused on majority stake or qualified minority investments in outstanding companies, with great value generation potential, active in traditional “Made in Italy” sectors.

As of November 30th 2023, the portfolio includes 7 investmentents, including 2 add-on and1 exit.

Italian Strategy Fund is currently active, but subscription period is concluded.Main Operations

FoodNess S.p.A.

RIELLO INVESTIMENTI SGR through its third private equity fund ITALIAN STRATEGY has acquired 73% of Foodness SpA. Foodness is a company with a 2018 turnover of €19.3 million and an EBITDA of €3.1 million, active in the production and marketing of alternative products to coffee (Barley, Ginseng, Ice cream creams, Chocolates, Teas and Infusions , etc.), in particular in the Free From segment (i.e. without glucose, lactose, gluten, etc.). The turnover is mainly achieved in the Ho.Re.Ca channel. (83% turnover) and for the remainder in the Retail channel (GDO and online - 7% sales in 2018). It was the first Italian player to position itself in the "Free From" segment and aims to exploit this competitive advantage to consolidate its leadership. Since the launch of the Foodness brand in 2014, sales have recorded growth rates of 40% (Cagr 15-18), gaining significant market shares and soon becoming the second player in alternative coffee products. To date it is present in over 17,000 bars and since 2016 the Company has also distributed in the large-scale retail channel and is now present in important brands.

Operation Detail

First Advisory

Riello Investimenti Sgr, through Italian Strategy, its third private equity fund, has acquired the majority share of the insurance broker First Advisory, leader in the "Private Life Insurance" sector. First Advisory is an independent platform specialized in the distribution of insurance products dedicated to the private banking market. With a portfolio of approximately 16 billion euros of intermediated policies, today First Advisory is the leader on the Italian market among independent B2B2C insurance platforms and one of the largest players in Europe. The company has signed collaboration agreements with the major Italian and European insurance companies and with the main Private Banking, Wealth Managers and Family Offices divisions, to which it offers a proprietary software platform and front-middle-back office services

Operation Detail

Garmont International

Garmont International specializes in production and distribution of high-end shoes and accessories, in the outdoor sector (mountain climbing, trekking, climbing, backpacking and trail running), and tactical (boots, military style enthusiast), characterized by the high-quality materials and by a sophisticated design. Garmont distributes its products in more than 40 Countries.

Details

P&P Holding S.r.l.

Riello Investimenti SGR has acquired 60% of the P&P Group, active in metal coating through PVD (Physical Vapor Deposition) technology. P&P Holding S.r.l. is the parent company of Protec Surface Technologies S.r.l. and Protim S.r.l., both operating in the same Sector: Protec specializes in the assembly and sale of machinery for PVD coatings, while Protim creates coatings for third parties with PVD technology.

Operation Detail

Il Fornaio del Casale

Il Fornaio del Casale is a company specialized in the production and marketing of industrial pastry products and bread substitutes, and is a leader in the ready-made cakes and Carnival segments. Its products are marketed in the Italian and foreign markets mainly through its own brand "Gecchele" and the remainder in Private Label.

Operation Detail

Private Debt II

impresa ITALIA IIImpresa Italia II is the second Private Debt fund managed by Riello Sgr, which continues the investment activity of Impresa Italia I with €74 million asset under management.

The Fund invests in structured debt instruments, “minibonds” issued by Italian small and medium-sized enterprises to support their growth and the development of innovative projects.

As of 31th December 2023, the investment portfolio includes 10 operations.

Impresa Italia II is currently active, but subscription periodi is concluded.Main Operations

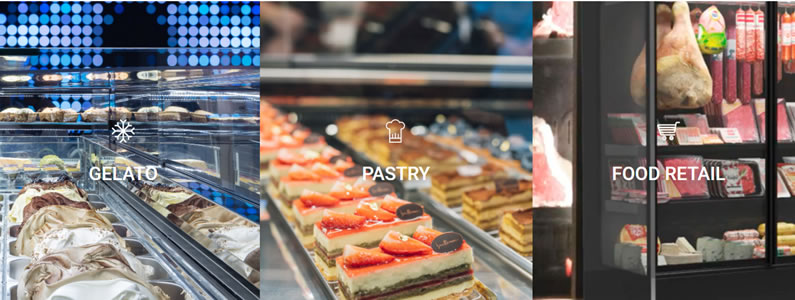

Clabo S.p.A.

Clabo S.p.A. is a world leader in the sector of professional display cabinets for ice cream parlors, pastry shops, bars, cafes and hotels. It is listed on the Euronext Growth Milan market.

Operation Detail

SolidWorld S.p.A.

SolidWorld S.p.A. is one of the main Italian "System Providers" in offering technologically advanced solutions and products for the automation and digitalisation of industrial processes, with particular reference to "three-dimensional" ("3D") digital innovation.

Operation Detail

Ekalab S.r.l.

Ekalab S.r.l is a company active in the research and production of food, dietary and sports supplements, offering a complete and tailor-made 360 degree service. The supplements produced by Ekalab are available in liquid, solid, powder and granulated forms. The company invests heavily in innovation and respect for the environment thanks to research and development on new generation materials and technologies.

Operation Detail

A.R.S Tech S.r.l.

A.R.S Tech is a world leader in advanced technologies for the production of components in carbon fiber composite materials. Its products are mainly intended for the motorsport and hypercar and supercar sectors. The company is considered a reference and high-end supplier by the main manufacturers in the sector.

Operation Detail

Bierrebi Italia S.r.l

Bierrebi Italia S.r.l is a company that operates as a manufacturer of industrial cutting machines for the textile sector, mainly dedicated to the basic apparel segment (underwear, t-shirts etc). The company offers tubular fabric cutting machines with Die Cutting technology. This technology allows you to maximize efficiency within long and highly standardized production cycles.

Operation Detail

VENTURE GROWTH CAPITAL I

LINFALinfa, launched in 2024, is the first italian Venture Growth Capital fund entirely dedicated to the AgriFoodTech sector, with €45 Mio commitment. The fund invests with minority operation in late stage or growth SMEs with a high level of process, product and/or service innovation. With a target fund size of up to €100 Mio, Linfa boasts a parterre of prominent investors, including pension funds, major banking foundations and prestigious family offices and industrial groups. Linfa is active and open to new subscriptions.