-

FCF

Private Equity IFCF, Private Equity Fund I, has managed resources exclusively originating from the family owned Gruppo Riello.

The Family Company Fund, with €35m assets under management, has completed 7 acquisitions of small to medium enterprises.

Family Company Fund has been liquidated in 2007.Main Operations

Giuseppe Bellora S.p.A.

L’azienda, fondata nel 1883 a Fagnano Olona (VA), è specializzata nella tessitura di lino, canapa e cotone e nella commercializzazione di tessuti per la casa a marchio “Bellora”.

Dettaglio Operazione

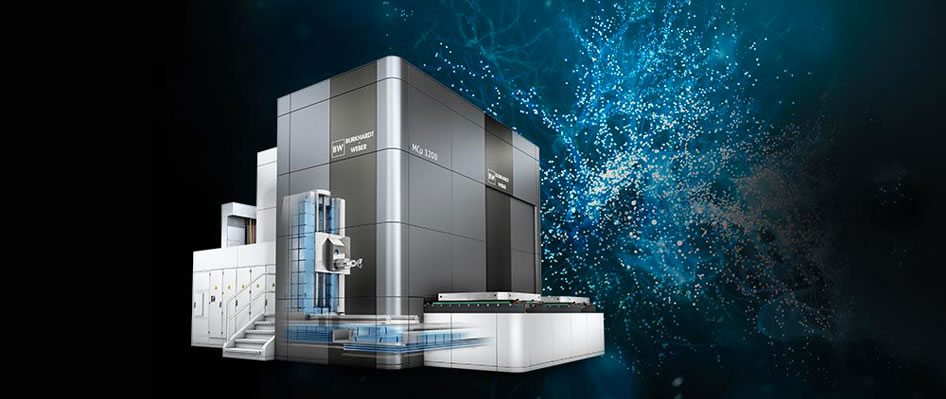

Burkhardt Weber Gmbh

Burkhardt Weber Gmbh è riconosciuta come una delle società più prestigiose nella realizzazione di macchine utensili e centri di lavoro orizzontali posizionandosi nella fascia alta del mercato. Nel corso degli anni ha saputo mantenere inalterato il proprio livello quantitativo continuando a sviluppare know how nella produzione di centri di lavorazione di elevata precisione.

Dettaglio Operazione

-

GATE

Private Equity IIIn 2008, Riello Investimenti Partners SGR launched GATE, the Private Equity Fund II, ruled by Banca di Italia and underwritten by institutional investors and industrial groups.

The fund, with €65m capital commitment, has completed 6 investments in the period between 2008-2013. Targeted sectors were widely diversified and uncorrelated from the negative economic trend of the global crisis, resulting in a consistent performance.

The GATE fund is currently in liquidation.Main Operations

Golden Goose S.r.l.

Golden Goose S.r.l opera nel settore del luxury fashion apparel ed è specializzata nella realizzazione e commercializzazione di calzature, accessori e abbigliamento casual di fascia alta caratterizzati dall’alta qualità dei materiali e da un design sofisticato. La società detiene il marchio “Golden Goose Deluxe Brand”, caratterizzato da una forte visibilità e riconoscibilità.

Dettaglio Operazione

Pool Service S.r.l.

Nata nel 1986 Pool Service S.r.l. realizza prodotti per la cura dei capelli destinati al canale professionale (acconciatori). La società, con sede e stabilimento a Cairate (Va), distribuisce i propri prodotti a marchio di terzi sul canale della distribuzione specialistica ed in parte a marchio proprio e ha una spiccata propensione verso i mercati internazionali.

Dettaglio Operazione

-

IMPRESA ITALIA

Private Debt IThe debt fund Impresa Italia was launched in 2016 as one of the first in Italy, with €70m assets under management. The fund invests in structured debt instruments, the minibonds, issued by Italian SMEs. Between 2016-2020 the fund completed 17 deals.

It's investors are predominantly institutional investors.

Impresa Italia Fund is currently active, but subscription period is concluded.Main Operations

Spinosa S.p.A.

Spinosa S.p.A. produce e commercializza in Italia e all’estero mozzarella di bufala campana DOP.

Dettaglio Operazione

Panini Durini

Panini Durini è l’insegna di una catena di “lunch bar” dal format innovativo e dal concept italiano.

Dettaglio Operazione

-

ITALIAN STRATEGY

Private Equity IIIPrivate Equity Fund III, Italian Strategy has 117 Mio Asset under Management, raised from high net worth individuals and leading institutional investors: Pension funds, Foundations, including investors that have previously underwritten funds managed by Riello Partners Sgr.

Italian Strategy is focused on majority stake or qualified minority investments in outstanding companies, with great value generation potential, active in traditional “Made in Italy” sectors.

As of November 30th 2023, the portfolio includes 7 investmentents, including 1 exit.

Italian Strategy Fund is currently active, but subscription period is concluded.Main Operations

FoodNess S.p.A.

RIELLO INVESTIMENTI PARTNERS SGR attraverso il suo terzo fondo di private equity ITALIAN STRATEGY ha acquisito il 73% di Foodness SpA.

Foodness, è una società con un fatturato 2018 pari ad € 19,3 mln ed un ebitda pari ad € 3,1 mln, attiva nella produzione e commercializzazione di prodotti alternativi al caffè (Orzo, Ginseng, Creme gelato, Cioccolate, Thé e Infusi, etc.), in particolare nel segmento Free From (ossia senza glucosio, lattosio, glutine, etc). Il fatturato è realizzato prevalentemente nel canale Ho.Re.Ca. (83% fatturato) e per il residuo nei canale Retail (GDO ed online - 7% vendite 2018). E’ stato il primo player italiano a posizionarsi nel segmento «Free From» ed ha l’obiettivo di sfruttare questo vantaggio competitivo per consolidare la propria leadership. Dal lancio del brand Foodness, avvenuto nel 2014, le vendite hanno registrato tassi di crescita del 40% (Cagr 15-18) guadagnando consistenti quote di mercato e diventando presto il secondo player nei prodotti alternativi al caffè. Ad oggi è presente in oltre 17.000 bar e dal 2016 la Società distribuisce anche nel canale GDO ed è oggi presente in importanti insegne.

Dettaglio Operazione

First Advisory

Riello Investimenti Partners Sgr, attraverso Italian Strategy, il suo III fondo di private equity, ha acquisito la quota di maggioranza del broker assicurativo First Advisory, leader nel settore del “Private Life Insurance”. First Advisory è una piattaforma indipendente specializzata nella distribuzione di prodotti assicurativi dedicati al mercato del private banking. Con un portafoglio di circa 16 miliardi di euro di polizze intermediate, oggi First Advisory è leader sul mercato italiano tra le piattaforme assicurative indipendenti B2B2C ed uno dei più grandi player in Europa. La società ha siglato accordi di collaborazione con le maggiori compagnie assicurative italiane ed europee e con le principali divisioni di Private Banking, Wealth Managers e Family Offices, alle quali offre una piattaforma software proprietaria e servizi di front-middle-back office.

Dettaglio Operazione

Garmont International

Riello Investimenti Partners Sgr, attraverso il suo terzo fondo di private equity Italian Strategy, ha acquisito il 65% di Garmont International, società italiana tra i leader nel settore delle scarpe tecnico sportive, outdoor e tactical, con un fatturato di oltre €20 Mio. L’azienda è specializzata nella realizzazione e commercializzazione di calzature e accessori di fascia alta, nel segmento “outdoor” (alpinismo, trekking, arrampicata, backpacking e trail running) e “tactical” (boots, military style per appassionati), caratterizzati dall’alta qualità dei materiali e da un design sofisticato. Garmont distribuisce i propri prodotti in più di 40 Paesi e ha realizzato un ambizioso piano strategico volto a consolidare il posizionamento attuale nel mercato “outdoor”, a sviluppare nuovi segmenti attraverso lo studio ed il lancio di nuovi prodotti.

Dettaglio Operazione

P&P Holding S.r.l.

Riello Investimenti Partners SGR ha acquisito il 60% del Gruppo P&P, attivo nel rivestimento di metalli attraverso la tecnologia PVD (Physical Vapor Deposition). P&P Holding S.r.l. è la controllante di Protec Surface Technologies S.r.l. e Protim S.r.l., entrambe operative nello stesso settore: Protec è specializzata nell’assemblaggio e vendita di macchinari per rivestimenti PVD, mentre Protim realizza rivestimenti conto terzi con tecnologia PVD.

Dettaglio Operazione

Il Fornaio del Casale

Il Fornaio del Casale è un’azienda specializzata nella produzione e nella commercializzazione di prodotti di pasticceria industriale e sostitutivi del pane, ed è leader nei segmenti delle torte pronte e nella ricorrenza del Carnevale. I suoi prodotti vengono commercializzati nel mercato italiano ed estero principalmente attraverso il proprio marchio “Gecchele” ed il restante in Private Label.

Dettaglio Operazione

-

IMPRESA ITALIA II

Private DebtImpresa Italia II is the second Private Debt fund managed by Riello Sgr, which continues the investment activity of Impresa Italia I with €74 million asset under management.

The Fund invests in structured debt instruments, “minibonds” issued by Italian small and medium-sized enterprises to support their growth and the development of innovative projects.

As of 30th November 2023, the investment portfolio includes 9 operations.Impresa Italia II is currently active, but subscription periodi is concluded.Main Operations

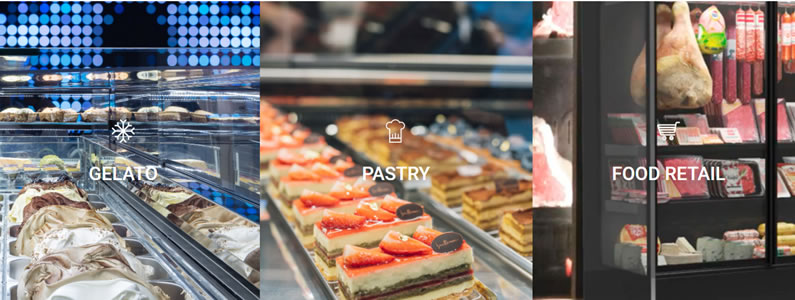

Clabo S.p.A.

Clabo S.p.A. è leader mondiale nel settore delle vetrine espositive professionali per gelaterie, pasticcerie, bar, caffetterie e hotel. È quotata sul mercato Euronext Growth Milan.

Dettaglio Operazione

SolidWorld S.p.A.

SolidWorld S.p.A. è uno dei principali “System Provider” italiano nell’offerta di soluzioni e prodotti tecnologicamente avanzati per l’automazione e la digitalizzazione dei processi industriali, con particolare riferimento all’innovazione digitale “tridimensionale” (“3D”).

Dettaglio Operazione

Ekalab S.r.l.

Ekalab S.r.l is active in the research and production of nutritional supplements and offers a complete and custom-made service. The supplements produced by Ekalab are available in liquid and solid form, in powders and granulates. Innovation and respect for the environment are important for the company as well as R&D activities on new materials and technologies.

Operation Details

A.R.S Tech S.r.l.

A.R.S Tech è leader mondiale nelle tecnologie avanzate di produzione di componentistica in materiali compositi in fibra di carbonio. I suoi prodotti sono destinati principalmente al settore del motorsport e delle vetture hypercar e supercar. L’azienda è considerata un fornitore di riferimento e di gamma alta dai principali produttori del settore.

Dettaglio Operazione

Bierrebi Italia S.r.l

Bierrebi Italia S.r.l è un’azienda che opera come produttore di macchine da taglio industriali per il settore tessile, dedicate principalmente al segmento del basic apperel (underwear, t-shirt etc). L’azienda offre macchine da taglio di tessuti tubolari con tecnologia Die Cutting. Questa tecnologia permette di massimizzare l’efficienza all’interno di cicli produttivi lunghi e fortemente standardizzati.

Dettaglio Operazione